6 Keys To A Winning Business Model For Your Customers

Startup Professionals Musings

OCTOBER 21, 2023

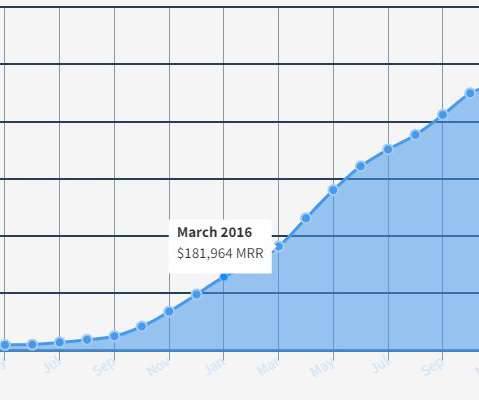

How do you convince investors that your business model will really work, before you have a revenue stream that exceeds your expenses? Even if you are bootstrapping your business, and you are the only investor, you should be asking yourself the same question. Plan for a real revenue model.

Let's personalize your content