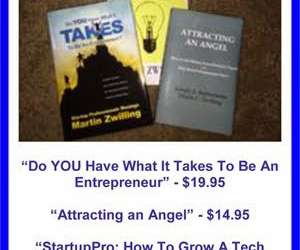

5 Keys To A Viable Spending Rate And Cash Management

Startup Professionals Musings

MAY 14, 2023

Deferred payments start with stretching the payables period but, more importantly, include giving employee equity in lieu of a higher salaries and negotiating vendor deferred payments out of future revenues. This could equate to two technical founders (with a minimal salary), funding two developers for a year.

Let's personalize your content