How I Got the Monkey Off My Back – Today Was a Good Day

Both Sides of the Table

MARCH 24, 2014

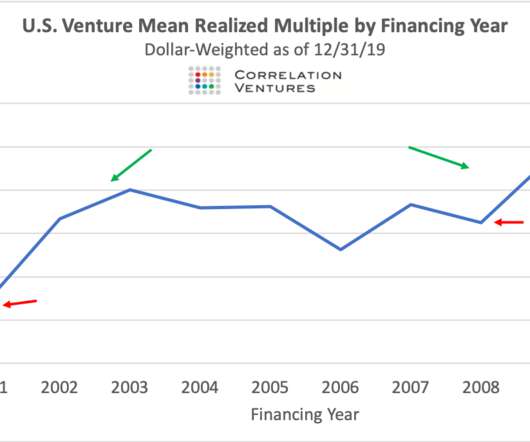

I spent my first year developing proprietary deal flow and learning the business and then the Sept 2008 / Lehman Bros collapse / financial meltdown happened. Working with early-stage teams : coaching, mentoring, setting strategy, rolling up sleeves: 9/10. I become a venture capitalist in September 2007 – exactly 6.5

Let's personalize your content