Our favorite blog posts of 2021

Version One Ventures

DECEMBER 20, 2021

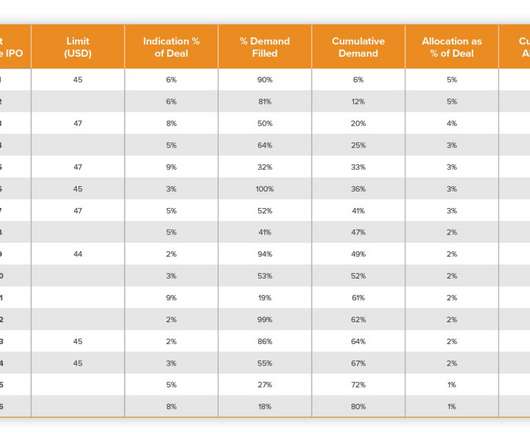

As we are approaching the end of another unprecedented year, it’s time to look back and share our top blog posts from the past 12 months. Looking back at V1’s first IPO, an unusual investment at the time: Coinbase. Our top three topics from the year: . 1/ Is 10x the new 3x? Announcing Fund IV and Ops Fund II. 2/ Climate and energy.

Let's personalize your content