The Importance of Proprietary Deal Flow in Early-Stage VC

Both Sides of the Table

MAY 4, 2013

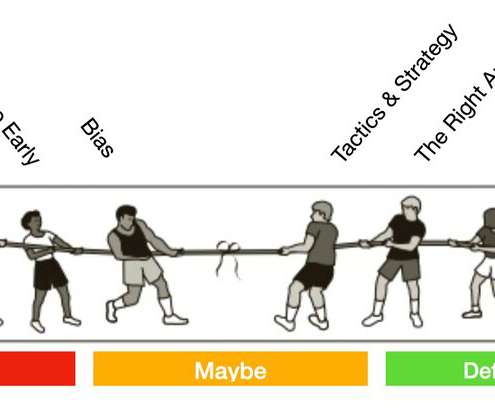

Should I trust my instincts for founders and products or should I be more focused on the market size or business plan? One of the major calibration pieces for me was where to find deal flow. As a VC you want to feel like you have “proprietary sources” of deal flow. It is not my proprietary deal flow.

Let's personalize your content