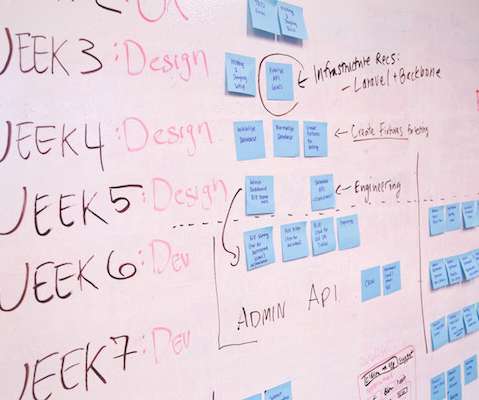

Accidental VC: When, Exactly, Should Seed-Stage Startups Look for Office Space?

View from Seed

MAY 14, 2015

So, when should a seed-stage founder — who, let’s face it, isn’t launching a business because they’re pumped to find corporate real estate — actually start looking for a legitimate office? Now then, back to your regularly scheduled programming about building meaningful businesses and talented teams to actually fill those offices.

Let's personalize your content