Startup Metrics

TechEmpower

JULY 31, 2023

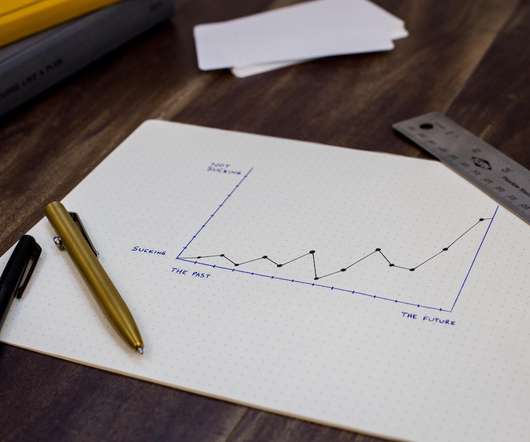

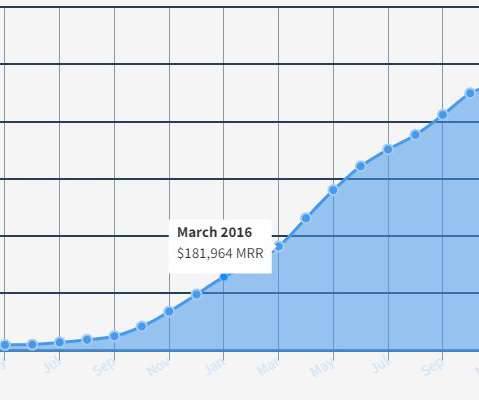

When talking to startup founders or other innovators, we always ask questions to better understand their business as a core. Start by building just enough of your product to get early CAC and CLV signals (they won’t be perfect). Next, define what you need from a metrics and reporting standpoint. What does the business do?

Let's personalize your content