Is the Lean Startup Dead?

Steve Blank

SEPTEMBER 5, 2018

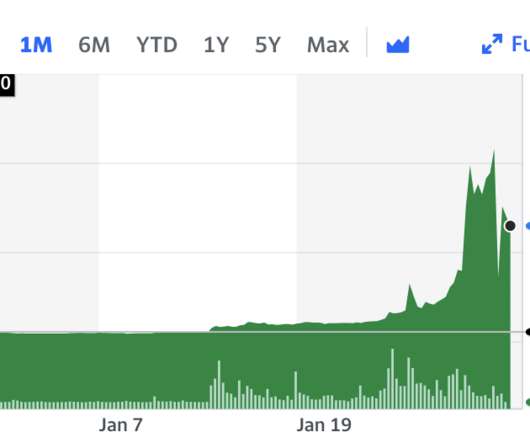

As a reminder, the Dot Com bubble was a five-year period from August 1995 (the Netscape IPO ) when there was a massive wave of experiments on the then-new internet, in commerce, entertainment, nascent social media, and search. Massive liquidity awaited the first movers to the IPO’s, and that’s how they managed their portfolios.

Let's personalize your content