Is the Lean Startup Dead?

Steve Blank

SEPTEMBER 5, 2018

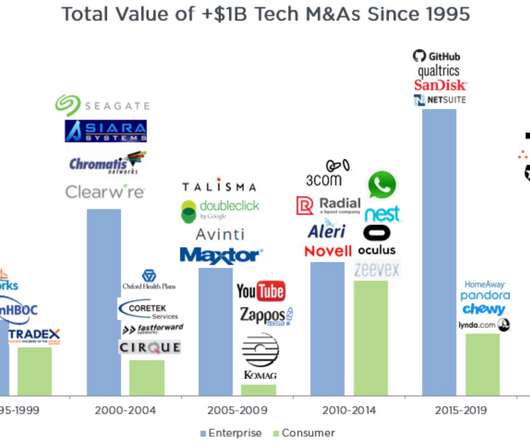

As a reminder, the Dot Com bubble was a five-year period from August 1995 (the Netscape IPO ) when there was a massive wave of experiments on the then-new internet, in commerce, entertainment, nascent social media, and search. IPOs dried up. Some have labeled this period as irrational exuberance. Then one day it was over.

Let's personalize your content