Who Should be on Your Startup Board?

Both Sides of the Table

FEBRUARY 20, 2019

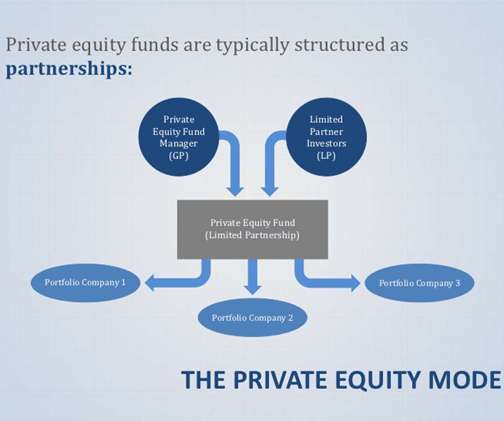

If you haven’t raised any money or if you raised a small round from angels or friends & family I would suggest you avoid setting up a formal board unless the people who would join your board are deeply experienced at sitting on startup boards. The Limited Partners (LPs) who back funds don’t expect their dollars to be passive.

Let's personalize your content