Is the Future of Healthcare a Telehealth Company for Every Condition?

View from Seed

FEBRUARY 24, 2021

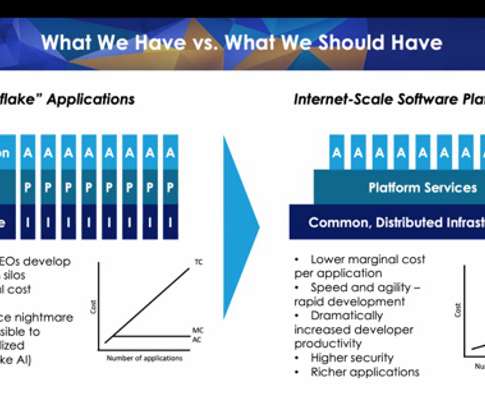

One of the most promising trends accelerating in digital health is the verticalization of digital health. Consequently, it is now feasible to build a large business by becoming a focused vertical provider that delivers superior care and patient experience in your specialty. . Scalable Go-To-Market .

Let's personalize your content