Seed Stage Funding 101: What it Is & How it Works

The Startup Magazine

AUGUST 11, 2023

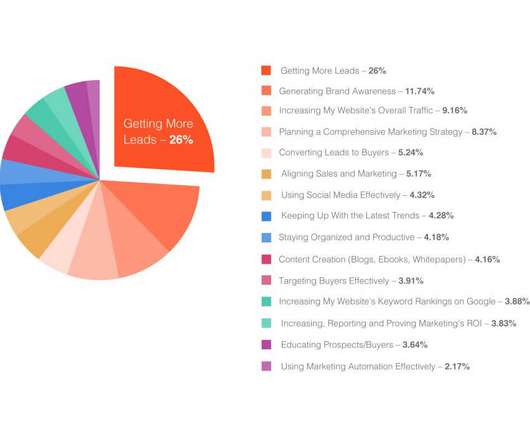

As a result of the fact that the typical business being evaluated by seed-stage investors needs a substantial amount of sales data or experience to draw on, seed-stage investors will consider the expected growth trajectory and existing track record, management, market share, and dangers. What is the Evaluation of the Funding?

Let's personalize your content