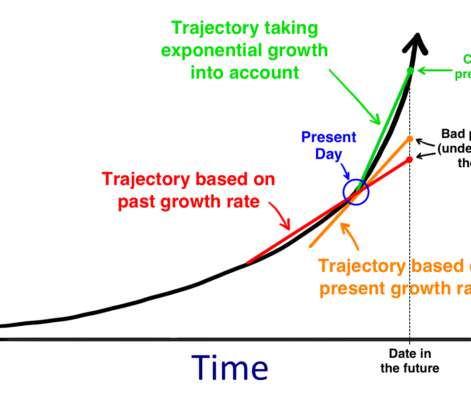

Why Innovation Unfolds Counter-Intuitively

View from Seed

JUNE 6, 2024

One of my favorite coffee table books is “Future Days: A 19th Century Vision of the Year 2000” It’s a collection of illustrations commissioned by a French artist in 1899 to try to depict what the world might look like in 100 years. The illustrations are fun, hilarious, and kind of jarring in some ways. Isaac Asimov apparently acquired the pieces and assembled them into book form in 1986.

Let's personalize your content