Startup Metrics

TechEmpower

JULY 31, 2023

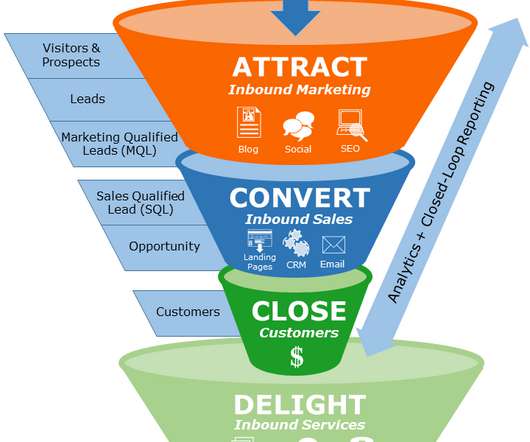

What does the business do? One way to approach that last question is to use this simple model: Customer Acquisition Cost (CAC) How will your business reach prospects? Customer Lifetime Value (CLV) How much money will your business generate from each converted customer? How does it meet customers’ needs?

Let's personalize your content