Technology, Innovation, and Modern War – Class 8 – AI – Chris Lynch and Nand Mulchandani

Steve Blank

OCTOBER 26, 2020

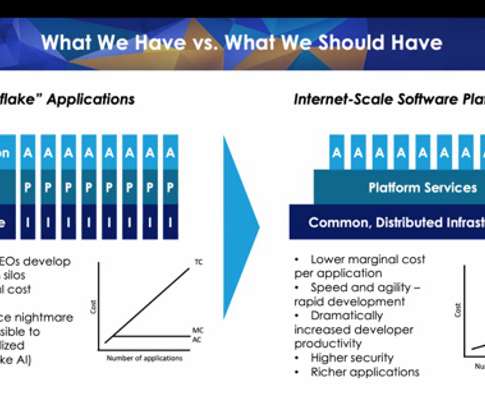

Joe Felter , Raj Shah and I designed a class to examine the new military systems, operational concepts and doctrines that will emerge from 21st century technologies – Space, Cyber, AI & Machine Learning and Autonomy. It’s a bunch of vertically integrated snowflake applications with a mouse and a keyboard and a screen.

Let's personalize your content