Is the Lean Startup Dead?

Steve Blank

SEPTEMBER 5, 2018

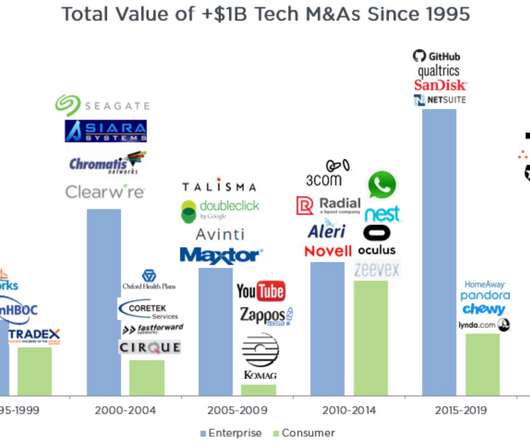

Most entrepreneurs today don’t remember the Dot-Com bubble of 1995 or the Dot-Com crash that followed in 2000. As a reminder, the Dot Com bubble was a five-year period from August 1995 (the Netscape IPO ) when there was a massive wave of experiments on the then-new internet, in commerce, entertainment, nascent social media, and search.

Let's personalize your content