Announcing NextView Operator Guilds

View from Seed

JANUARY 24, 2018

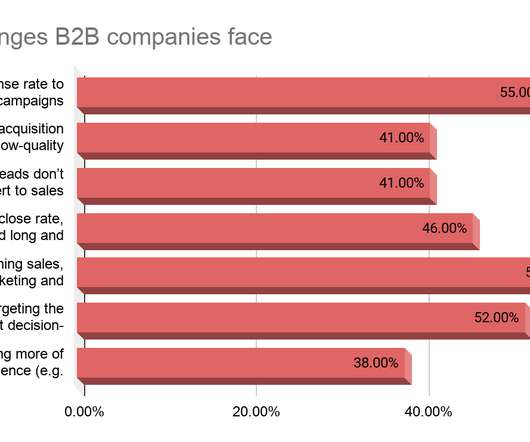

Getting more customers. We’re calling them NextView Operator Guilds. . The concept our Guilds is simple: We want to bring together small groups of Product and Go-to-Market experts to lend their time to support our portfolio company founders and key operators. Building a great product. Not running out of money.

Let's personalize your content