I Graduated Into The 2000 DotCom Crash, And It Was The Best Thing To Ever Happen To My Career

Hunter Walker

MARCH 16, 2023

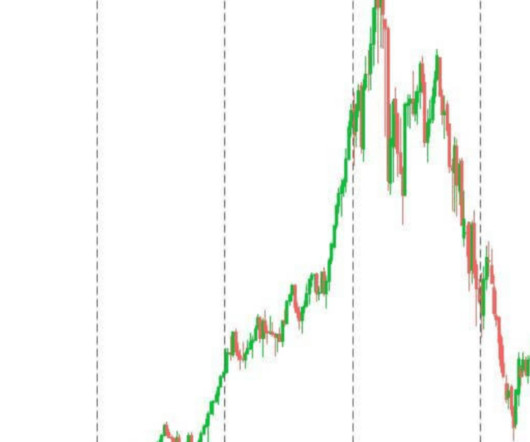

But by my graduation in June of 2000, the party had ended. companies; the Class of 1999 had founded the bad Internet 1.0 companies; and the Class of 2000 was just plain unemployed. As became clear quickly: the Stanford Business School Class of 1998 had founded the good Internet 1.0

Let's personalize your content